Thomas L. Wayburn, PhD in Chemical Engineering

Why Capitalism Requires an Expanding Economy

In the Alfred Hitchcock movie The Trouble with Harry, the trouble with Harry was that he was dead. The trouble with capitalism – in the strict sense of the word – is that it doesn’t exist. Capitalism is supposed to be when one produces more than one consumes so that part of what is produced can be used to enlarge the means of production, usually accompanied by a greater throughput of energy. Capitalism is when the pump that sucks energy out of the environment is increased in size by feeding back part of what is produced. This works as long as the supply of energy is unlimited; but, when the supply of energy remains only constant or is decreasing, one cannot have capitalism. This was explained in Chapter 2 of On the Preservation of Species [1]. We shall attempt an explanation of why what passes for capitalism in ordinary discourse requires an expanding economy, or rather why it attempts to force economic expansion even when economic shrinkage is indicated.

We have already shown why economic expansion is part of the definition of the word capitalism used in the strictest sense. But, those who still consider themselves capitalists in the face of hard limits on expansion continue to try to force the economy to grow. George Bush, the President of the United States at this writing (but perhaps forgotten when this is read), still believes in economic expansion and environmental protection. (To be fair, so do the other politicians.) This is a contradiction in terms unless one defines economic growth in such a way that it does not represent growth in consumable wealth. Personally, I have no problem with a society that produces half as many consumer goods, but does so without environmental destruction. But, if the quantity of consumer goods is halved and the population increases, each person will experience less than half the standard of living he did previously. Even though the air be better, most people will not recognize this as economic growth. The reason they want jobs, after all, is so they can have more things.

It remains to show, then, that we have good reason to believe the oft-stated assumption that capitalism, as it is commonly understood, requires economic growth, as economic growth is ordinarily understood. I have chosen to show this under two conflicting assumptions. Case 1: Capitalists are greedy; they are not willing to place limitations on the accumulation of wealth voluntarily. Case 2: Capitalists recognize that a steady-state economy is necessary and they will try to attain one if they can. (I shall indicate that they can’t.)

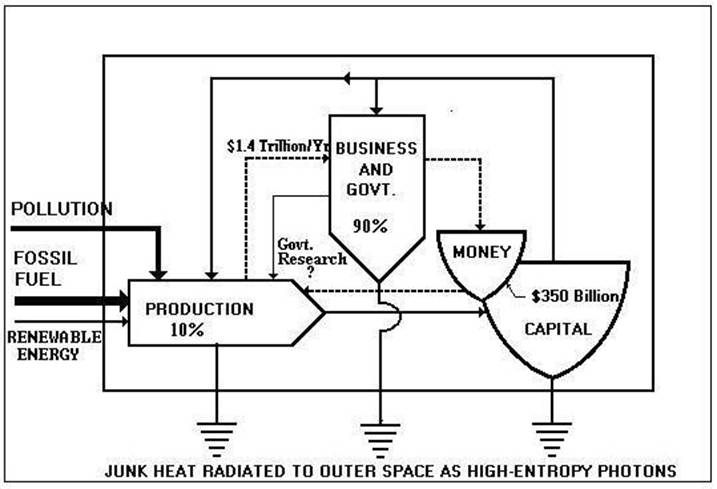

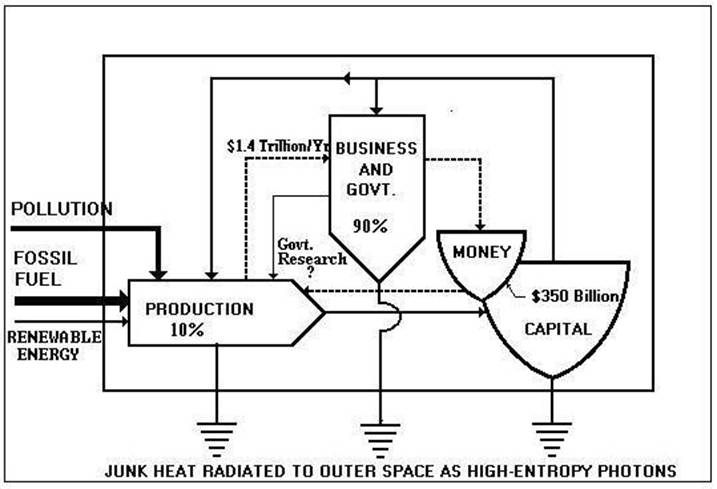

The emergy theory of H.T. Odum [2], described in On the Preservation of Species, pictures the economy as consisting of a giant cycle of money running countercurrent to a feedback loop of emergy, as shown in Fig. 2-4 of Chapter 2, reproduced here for the convenience of the reader. Whenever we speak of energy consumption in ordinary conversation, we do not really mean that energy is consumed. We all know that energy is conserved according to the First Law of Thermodynamics. We really intend to speak of the change in the Helmholtz availability function, A, which is energy minus the ambient temperature times entropy; i.e., A = U – ToS. So, whenever we say energy is consumed, we mean that our accumulation of Helmholtz availability is reduced.

Figure. Odum’s emergy diagram for the economy (modified by Wayburn)

The emergy of a primary fuel is the Gibbs availability of the fuel times the transformity where the transformity is the number of kWhrs of single-phase, 60 Hz, 110-volt AC electricity one can obtain from 1 kWhr of the primary fuel by an efficient process. Thus, 1.0 kWhrs of single-phase, 60 Hz, 110-volt AC electricity is my (arbitrary, but well-defined) choice for the unit of emergy and this is an electricity-based transformity. The embodied energy or emergy of anything else is the sum of all the emergy that went into producing it by an efficient process minus the emergy of any by-product formed.

When the supply of high-grade primary energy is essentially infinite, the rate of the flow of money determines the rate of input of energy into the system. Some of the energy is stored in the form of the emergy of capital assets, which is then fed back to the production process as well as accumulated, but some of the energy ends up being dispersed from both production and capital to the atmosphere as useless (junk) thermal energy, cf., the average person radiates about 0.1 kW. Depreciation of capital ends up as junk heat, normally. If we consider the employees as part of production, their consumption accounts for much of the junk heat.

The figure illustrates the situation. Businesspeople want the money cycle to flow as rapidly as possible because they can accumulate wealth by sucking little side streams off the main stream like little pigs suck milk from a sow’s teat. When the supply of emergy is limited, either at steady state or diminishing, the only way the rapid flow of money in the money cycle can be maintained is by inflating the currency, since the only true wealth is represented by emergy. Businesspeople competing for wealth will do anything, however, to keep the money cycle turning, even in times of limited emergy, because they believe that they can suck money off the cycle at the expense of the buying power of those who have less access to or no access to the money cycle; but, they will spill blood, if necessary, to keep the emergy coming as fast as possible.

This is the picture of the world subscribed to in this essay. It allows us to recognize that the only way to reduce the excessive consumption of emergy, with all of its catastrophic environmental effects as well as its natural limitation upon the permanence of the economic system it supports, is to eliminate the incentive to turn the money cycle as fast as possible. The thrust of this essay is to show that this can be accomplished most readily by eliminating the money cycle. Business people and their toadies probably consider themselves decent hard-working (perhaps even religious) folks. With malice toward none, I consider them harmful parasites. (Subsequent to this writing, I learned to call this activity chrematistics.)

Enterprises wish to grow at least to the point where they achieve optimum economy of scale. But, they have excellent reasons for growing beyond that point (even if they cannot maintain optimality from the point of view of economy of scale by subdividing their operations): The larger the enterprise, the greater the political clout. A fundamental theme running through this essay is that businesses through various practices, in particular, by contributing to the campaign funds of candidates for public office, especially incumbents, usurp political power over the affairs of the nation. It is fair to say that the fundamental business of government is to provide support for business, even if that support happens to be regulation when regulation favors business as a whole. It is also probably fair to say that government fails to carry out its “appointed” mission whenever the needs of business conflict with the needs of government itself. When the needs of one business conflict with those of another, probably the needs of the larger business will take precedence for all the obvious reasons. But, managers of economic enterprises have other reasons for favoring growth, in particular, growth of their own enterprise, namely, the greater the enterprise over which one presides, the greater the money and power, typically. Thus, stockholders and managers favor growth.

But, the above reason is incomplete. The reader should now read Addendum 2 (below) which contains David Delaney's explanation, which is much better. Then, read Case 2, which is far-fetched given our past experience of capitalists; however, Case 2 and Addendum 1 (below) should be considered. Taken all together, we have shown that capitalism requires an expanding economy.

Suppose market economies, as exemplified by capitalism, did not grow. Growth in the number or size of enterprises would have to be balanced by appropriate shrinkage elsewhere. This in itself would perpetuate the vicious competition between businesspeople that we are witnessing now, and some people think that’s good. We must assume that some portion of the production of the economy will be absorbed by capitalists. In a stationary economy with the capitalist’s share growing, everyone else would become dissatisfied and the system would properly become unstable.

If the capitalist’s share remained stationary or shrunk, the only way new people could enter the capitalist class would be by virtue of some capitalists dropping out or taking a smaller share, which they would not be willing to do voluntarily. Capitalists would do terrible things to avoid being forced out by other capitalists. And yet, the possibility of new people entering the capitalist class is the only thing that perpetuates the version of the American dream that extends beyond merely owning one’s own home. It is the carrot in front of the proletarian donkey or, at least, the bourgeois donkey. One wonders if capitalism could survive without what I have called the Horatio Alger Myth.

In addition, one wonders how the system would accommodate the capitalist’s children. Unless the growth of the capitalist class were accommodated by a shrinkage in the share of production appropriated by capitalists, which we expect capitalists to resist, capitalists must replace only themselves and their spouses by procreation and even this type of voluntary moderation would fail to address the need to permit members of other classes to become capitalists.

It appears, then, that we have deduced a number of absurdities that must have come from the assumption that the economy does not grow. Even 1% growth in population per generation is inconsistent with permanence, and, as we all know, population growth is occurring at a much faster rate than that, viz., about 1% per year. Because of the necessity of growth, and for other reasons described in my other essays, market economies, commerce, and trade are not compatible with the survival of the human race on this earth. A flight to outer space is impractical and unethical. The export of human institutions, such as commerce, to outer space would constitute space pollution. Look what we have done to our own wildernesses. Doubters might wish to look at my essay on space in this volume.

It is possible that we have constructed our argument in reverse. Perhaps what is more likely is that shrinkage will be forced upon us by the exigencies of nature. We don’t believe that capitalism can exist under these circumstances, so it will transform itself into something else whether anyone wants it to or not. The question is what will it transform itself into. One can only hope that the nature of the transformation will not be forced upon us in an undesirable way. If the nature of the change depends on what people think we will have an opportunity to improve the world we live in.

Houston, Texas

Circa 1989

1. Wayburn, Thomas L., On the Preservation of Species, Houston (1998).

2. Odum, Howard T., and Elizabeth C. Odum, Energy Basis for Man and Nature, McGraw-Hill, New York (1976).

A careful reader might argue that, nowadays, development might consist in technological improvement whereby what formerly was large and bulky is now small and portable and, therefore, requires less emergy to construct and, consequently, is much cheaper for the consumer. This is a good observation; but, on closer inspection, fails. First, as to “less emergy to construct”, today’s electronic gadgets, cf. cell phones, weigh less and, therefore, involve the heat of fusion of far less material, which, after all, is a decent first measure of energy costs; however, because of that same technological progress, they become obsolete at a much faster clip and join the scrap heap of industrial civilization, which increases the entropy of the universe more rapidly not more slowly. Remember the cell phone ad that culminated in the actor’s (obsolete) cell phone being thrown off a roof into a (fortuitously) passing dump truck. (What am I to do with my old 486 computer on which the earlier version of this essay was written?)

As to “cheaper”, while it appears that the reduction in price of electronic goods corresponds proportionally to the reduction in emergy (contrary to Odum’s prediction), the reduction in price, on the contrary, is due to China’s policy of mercantilism, whereby goods are manufactured by essentially slave labor to amass US dollars to purchase capital goods that will make the state-capitalistic so-called communist republic more like America than it is now. Thus, the spread of Materialism and the subversion of Communism are accompanied by accelerating growth in entropy (and the destruction of the planet) as predicted by the political economic theory put forth on this website.

Houston, Texas

Today I read “What to do in a failing civilization” by David M. Delaney. It contained the best explanation of why American-style capitalism requires growth I have ever seen. With the kind permission of the author, it is reprinted below. The full paper and other essays by Delaney can be found at http://geocities.com/davidmdelaney/.

Economic growth requires increasing the amount of high quality energy and materials degraded by the economy each year. Economic growth on a finite planet will eventually stop. If it does not exhaust the resources needed for its continuation, it will stop earlier for some other reason. Allowing resource depletion and biosphere degradation to terminate economic growth will produce catastrophe. Unfortunately, our dependence on economic growth makes it extremely unlikely that we will give it up voluntarily before the catastrophe. Our dependence has at least four aspects: A) in the need to deal with adverse consequences of labor-reducing innovations, B) in commercial bank money, C) in the need to maintain tolerance of inequality, and D) in financial markets.

A) The first dependence on economic growth is in the need to avoid the adverse consequences of innovations that reduce the need for labor.1 By definition, each labor-reducing innovation either increases the amount of a good produced or throws some people out of work. Firms that create or exploit a labor-reducing innovation create new jobs internally by driving other firms out of business. The new jobs implementing the innovation offset the loss of jobs caused by the innovation, but the innovating firms don’t necessarily hire all of the job losers, because the innovation reduced the total amount of labor needed to produce the original amount of the good. In order to re-employ all job losers, the economy must grow to produce more of the good with all of the original workers, or produce more of some other good with the cheaper labor (the job losers) now available. In either case the economy grows. Much of what we consider progress is due to labor-reducing innovations. In order to live without economic growth, we would have to give up this kind of progress, or introduce arrangements to allow workers who become unproductive to retain their relative wealth and self-respect, or relegate most people to a repressed underclass. There is a powerful incentive to avoid these contingencies by encouraging economic growth.

B) The second dependence on economic growth is in the creation of money by the act of borrowing at interest from commercial banks. Much of the money in each loan by a commercial bank is created by the loan itself. The bank collects a fee—the interest—for providing the service of creating the money. Other ways of creating money have been explored in theory and practice. Successful local currencies have been based on some of these alternatives, (see Douthwaite, Short Circuit, page 61) but all national money is now created by interest-bearing loans from commercial banks. This way of creating money contributes instability to an economy based on it. In order to keep the money supply from contracting when a loan and its interest are paid, a larger total of new loans must be created, increasing the money supply. (This is not transparently obvious. For a more detailed explanation, see Douthwaite, The Ecology of Money, page 24.) When the economy grows to match the increasing money supply, the value of money is relatively stable, and commercial-bank-created money is benign. If the rate of economic growth does not match the rate of growth of the money supply, the money supply becomes unstable. Given the use of money created by interest-bearing loans from commercial banks, an economy can minimize the resulting instabilities of the money supply by sustaining moderate growth. Monetary instability would put significant hazards in the way of deliberate attempts to contract our economy unless the creation of money was radically reformed.

C) The third dependence on economic growth is in the political and geopolitical need for tolerance of inequality. Differences of wealth are at least as great within the developed countries as they are between developed and developing countries. Think of the ratio of the average income of American CEOs to the average salary of workers in their companies. Domestically and internationally, the tolerance of the poor and middle classes for the existence of wealthier classes and countries depends on a belief in economic growth. The poor struggle, while seeing that others are wealthy and still others are grotesquely wealthy. The poor are told a story: if they keep to their work and to their diversions, and tolerate the rich, they will be better off in the future than they are today. They believe this story, or at least don’t revolt against it, because it is supported by propaganda and shared myths, and has been true for many. When economic growth disappears forever, the poor, like everyone else, will recognize that they will be progressively worse off, with no future relief possible. The peaceful tolerance by the poor and the middles for the rich will disappear. A peaceful end of economic growth would require redistribution of wealth, with consequent political and geopolitical contention. Desire to avoid the contention makes it unlikely that deliberate elimination of economic growth will be attempted before economic growth is ended by nature. The intolerance of differences of wealth that will then appear will itself not be tolerated by the rich, causing additional domestic and international conflict just at the advent of other adverse changes. At that time, if not before, tyrannical repression of the poor will greatly tempt the rich.

D) The fourth dependence on economic growth is in the financial markets—the mechanism of capitalization of public corporations. Public corporations, the main actors in industrial economies, depend on financial markets not only for capital for innovation, but for discipline, valuation, motivation, and a major part of their rationale for existence. Owners of capital—investors—give the use of it over to public corporations by buying equity or debt in financial markets. They do so only because they expect that they will, on average, and over the long term, receive back more than they gave up. That expectation disappears when most investors understand there will be no economic growth. Most of the apparent wealth of the world consists of equity and debt bought and sold in financial markets. . Any realistic possibility of the end of growth would fill investors with something like terror. Political initiatives to bring an end to growth will be opposed by investors with every means at their command. The controversial nature of proposals that would reduce or eliminate economic growth will likely prevent the proposals from reaching even the status of political contention. When the onset of sustained economic contraction is generally perceived, investors will withdraw from financial markets. The resulting failure of the markets will make many necessary developments impossible to finance and will produce confusion and stasis in public corporations just when we need them to adapt to new circumstances.